The Paycheck Protection Program: What It Means for Small Business Owners

We understand that these are uncertain times for many small business owners.

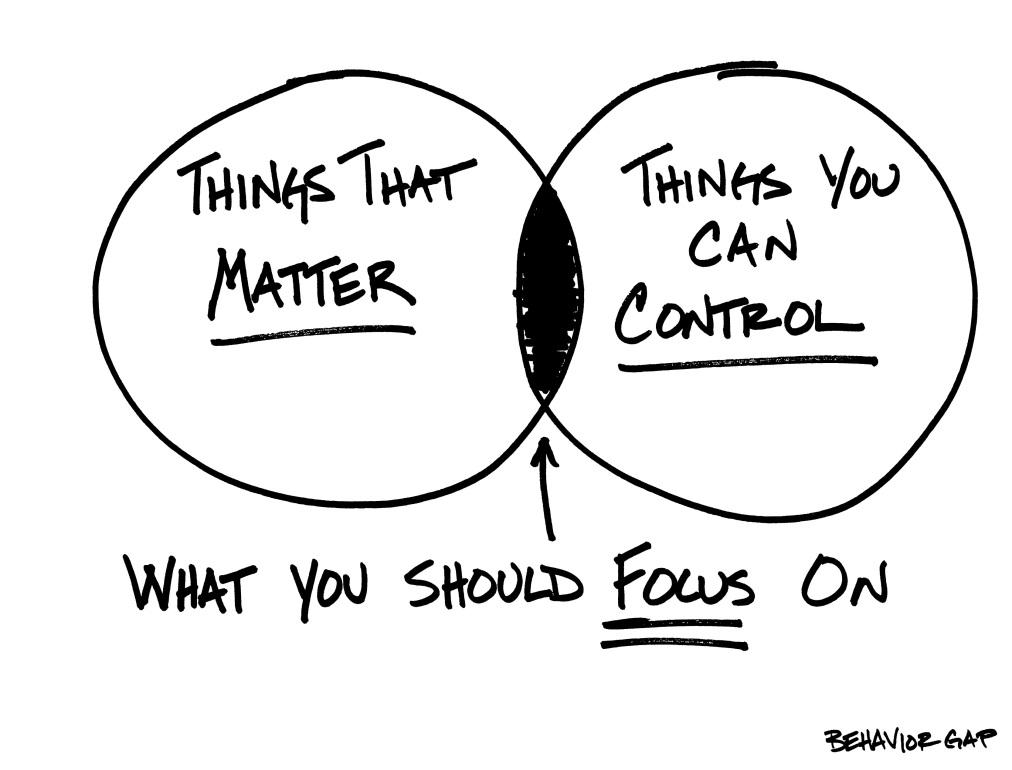

Staying Focused

There are no words to describe what we are experiencing. In the news, in our communities, in our own homes, and in the financial markets/world economy. However, it’s important to have some perspective. Now is the time to take care of not only your finances; but yourself, your family, and your communities.

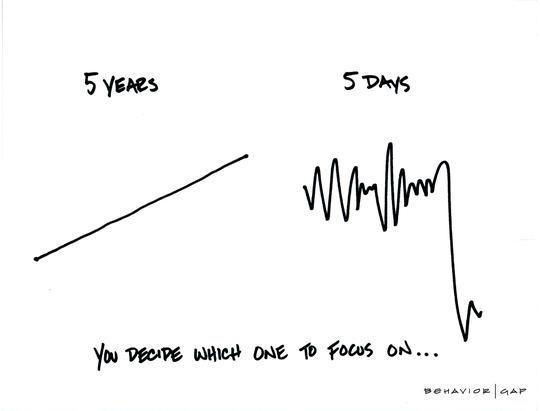

Staying Calm Amidst Market Turbulence

Market lows often result in emotional decision making. Investing for the long-term while managing volatility can result in a better retirement outcome.

5 Common Mistakes People Make When Creating a Financial Plan

We all make mistakes, financial and otherwise. Are you making any of these common financial planning mistakes?

The Importance of Financial Literacy in the Classroom

The multitude of our debt problem could prevent millions of Americans from getting ahead. Instilling basic financial concepts into children could drastically change the trajectory of their life. Perhaps equipping the next generation with these essential life skills will enable them to undo their parent's mistakes.

CDs: Certificate of Depreciation

CDs are often touted as a safe way to invest. In order to be a successful investor, we must mitigate risk. Therefore, wouldn't investing in something as safe as a CD would be a good investment decision? Not so fast.

The Currency of Today is Time

When you manage your money correctly, it can help you buy time. Time has a funny impact on money too. The longer you wait to create a financial plan, the harsher time will treat you.

A Microwave Versus a Slow Cooker

There is no workaround. There is no way to game the system. There is no microwave. Planning and time are essential to investing. Also throw in a little help from a trusted Certified Financial Planner™!

What the Wealth?!

What the Wealth?! breaks down the complexities of money. This book makes personal finance easy to understand and provides actionable steps that when put together, will give you a financial plan that covers every stage of life.