A Guide to Retirement Planning

Retirement is a far-off concept, something that is decades away. Until it isn’t. Retirement isn’t something you want to let sneak up on you. And while many people plan to work until 65 or beyond, sometimes when we retire is not within our control. There is also a large subset of people who want to retire early, whether for financial reasons or simply to enjoy life while they are still young enough to do so.

No matter when you plan to retire, there are a few key things you need to do to make sure you are prepared.

That’s why it’s important to have a retirement plan. Not only will this give you a roadmap to follow, but it can also help ease the anxiety and stress that comes with thinking about life after work.

The first step in creating a retirement plan is to assess your current financial situation. This includes taking a close look at your income, debts, assets, and expenses. This will give you a clear picture of where you stand financially and what you will need to do to retire comfortably.

Once you have a good understanding of your finances, you can start to make some retirement decisions. This includes figuring out how much money you will need to have saved to retire when you want to retire, and what kind of lifestyle you want to have in retirement.

In this, in-depth blog, we are going to cover everything you need to know about retirement planning.

How Much Money Do I Need to Retire?

Part of the reason retirement is such a vague concept for some people is that it’s hard to know just how much money you will need to retire. We all like to have an endpoint, a moment when we know we’ve reached a goal. For example, if you want to lose weight, you generally have a set number of pounds you’d like to lose. When you reach that number, you’ve met your weight loss goal.

Retirement is vaguer because none of us can see into the future, so there are a lot of unanswered questions. At what age will I retire, what will the cost of living be, what will inflation be, what will tax rates be, how much medical care will I require, and how long will I live?

While none of us can answer those questions, there are formulas and rules of thumb that can help us find a pretty good ballpark endpoint, the dollar amount we need to have saved before we retire. Millions of people have retired before us in all kinds of economies, so we’re not in totally uncharted waters!

Median Retirement Savings by Age

Now let’s look at other people’s numbers. Spoiler alert, not too good!

- 18-24: $4,745

- 25-29: $21,731

- 30-34: $21.731

- 35-39: $48,710

- 40-44: $101,899

- 45-49: $148,950

- 50-54: $146,068

- 55-59: $223,493

- 60-64: $221,451

- 65-69: $206,819

Where are you compared to others your age? We might find these numbers shocking, but we really shouldn’t, given that 56% of Americans don’t have the cash in an emergency fund to cover a $1,000 expense.

You could skate through an emergency on credit cards or perhaps a loan from a family member or friend. Retirement? Not so much.

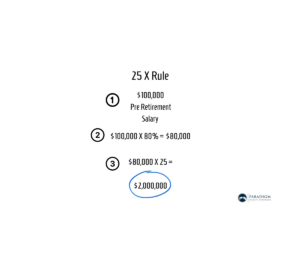

The Multiply by 25 Rule (The 25 X Rule)

This is the first formula/rule of thumb we can use to get our retirement number. Here’s another rule of thumb. You’ll need 80% of your pre-retirement income in retirement. To get your retirement number, multiply whatever that 80% is by 25. Here’s an example:

- $100,000 pre-retirement salary

- 80% of $100,000 is $80,000

- $80,000 x 25 is $2 million

If you need $80,000 per year in retirement, your retirement number is $2 million.

The 4% Rule

The 4% Rule was created by William Bengen, a retired financial advisor. The rule states that if at least 50% of your retirement portfolio is invested in stocks and the rest in bonds, you can safely withdraw an inflation-adjusted 4% each year during retirement for at least 30 years and never touch the investment principal.

The rule has been around since 1994 and was tested in simulations against all kinds of conditions, including some of the worst bear markets in history. In all scenarios, 4% was a safe withdrawal rate.

Using our $2 million retirement number, 4% is the $80,000 per year we estimated we’d need each year using the Multiply by 25 Rule:

$2 million x 0.04 = $80,000

There is debate around the continued relevancy of the 4% Rule. Some financial experts believe you might need to go down to a 3% withdrawal rate per year, and others believe you can go as high as 6%.

It depends on how flexible your yearly spending forecast is. Is it pretty bare bones, or have you figured in a lot of discretionary spending that could be cut if necessary? But overall, the 4% Rule remains a pretty good retirement rule of thumb.

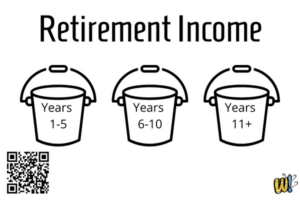

The Bucket Strategy

The Bucket Strategy is a retirement planning strategy. When you’re one to three years from retirement, you split your assets into three portfolios, the buckets. Each bucket is assigned a different job, time horizon, asset allocation, and risk level. The strategy lets you use some of your assets as income to pay your living expenses while others are left to grow.

Bucket One: Short Term Bucket

Bucket One is for expenses not covered by other sources of income like Social Security or pensions and also acts as your emergency fund in the first five years of retirement. This bucket helps protect you from market fluctuations and timing risks. The assets inside are conservative, so they’re not severely impacted in a lousy market—things including money market funds and short-term bonds.

Bucket Two: Intermediate Bucket

Bucket Two gives you income for years six through 10 of retirement and can be used to refill Bucket One if it runs dry. Its assets help protect you from timing and inflation risk. The risk level for Bucket Two is higher than Bucket One, and assets can include dividend-paying stocks, individual bonds, bond funds, and laddered bond portfolios.

Bucket Three: Long-Term Bucket

Bucket Three provides income for years 11 and beyond. Its assets help protect you from timing and inflation risks and can be included in your estate plan. Bucket Three has the highest risk level because its time horizon is longer than the others, and it has the most time to recover from bad markets. Assets may include equities, commodities, and real estate.

The Bucket Strategy can be especially useful in times of economic and market uncertainty. Diversification is the cornerstone of a healthy portfolio and dividing assets into three buckets provides additional diversification. If the market falls early in your retirement, you have enough money in Bucket One for expenses, so Buckets Two and Three have time to rebound.

What is the Best Way to Save For Retirement?

Investing for retirement doesn’t have to be complicated. These are the best ways to do it!

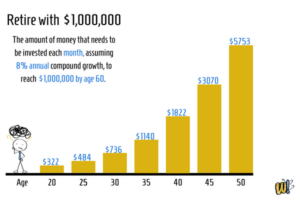

Start Early

The best way to save for retirement is to start early. Take a look at this graphic, and you’ll see why.

Time is the most essential ingredient when you’re investing. You don’t have to be a genius stock picker; you don’t have to time the market; you just have to invest early and consistently.

Pay Yourself First

Many times we intend to invest, but we don’t make it a priority. Change that. Pay yourself first! That means making your investment contributions as essential and non-negotiable as paying a bill you wouldn’t dare not pay, like your rent or mortgage. At certain points in life, paying yourself first might mean sacrificing other things or delaying gratification, things that don’t come naturally to most humans!

To outwit your baser instincts, make investing automatic. 401(k)s are a good way to do this, more on them below. But you can set up auto-deposits into pretty much any investing account. Do it! Set it and forget it. You can’t spend what you don’t see.

Contribute to Your 401(k)

An employer-sponsored 401(k) is the first foray into investing for many people because it’s seamless. Your employer has set up the account, and you have a selection of options. The money comes out of your check automatically, so all you have to do is choose a fund and opt in.

401(k)s are tax-advantaged retirement accounts. They lower your taxable income for the year. If your salary is $65,000 per year and you contribute $20,500 to your 401(k), you will only pay income tax on $44,500. The money in the account grows untaxed. You won’t pay taxes on the money until you start making withdrawals during retirement, and for many people, their retirement tax bracket is lower than the brackets they were in during their working years.

Using 401(k) Match and Roth Options

Even better, some employers offer matching contributions up to a limit. This is free money, something that doesn’t come along often! Ideally, you will max out your 401(k) each year. If that’s not possible, contribute at least the amount required to get the match.

Some 401(k)s offer a Roth option. With a Roth 401(k), you pay taxes on your contributions now, but the money grows tax-free, and you won’t pay taxes on withdrawals during retirement. This is a good choice if you think your tax bracket will be higher in retirement than it is now.

If you’re self-employed, you can set up a solo 401(k). This is similar to a regular 401(k), but there are a few key differences. You can contribute as both an employee and employer.

There are other employer-sponsored retirement plans, like 403(b)s, TSPs, and SIMPLE IRAs but 401(k)s are the most common.

Contribute to an IRA

An IRA gives you another retirement investing vehicle. You have two options, traditional and Roth IRAs. Contributions to a traditional IRA may be tax deductible, and the earnings grow tax-deferred until you start making withdrawals in retirement. Roth IRA contributions are made with after-tax dollars, so once you begin withdrawing in retirement, the distributions are federal income tax-free and may be state-income tax-free if certain holding period requirements are met.

Contribute to a Roth IRA

A Roth IRA is a retirement account that provides tax-free growth and federal tax-free withdrawals in retirement as long as you’re 59 ½ or older and have owned the account for at least five years.

Roth IRAs don’t have RMDs (Required Minimum Distributions), and you can contribute to the account for as long as you have qualifying earned income. You can leave your Roth IRA to your beneficiaries, and their withdrawals will be tax-free.

For 2022, the contribution limits are $6,000, with an additional $1,000 for those 50 and older. You have until April to make contributions that will count towards your taxes for the prior year, but if you can max out before that, you’re giving your money additional time to earn tax-deferred.

There are income limits for a Roth IRA. If you file as a single person, your Modified Adjusted Gross Income (MAGI) must be under $144,000 for the 2022 tax year. If you’re married and file jointly, the limit is $214,000.

A Health Savings Account (HSA) is one of my favorite “backdoor” retirement savings methods. HSAs are accounts to help those with high deductible insurance plans save taxes on money for medical expenses not covered under your insurance plan.

The contributions can be rolled over each year; contributions are not taxed, and the money in the account grows tax-free and isn’t taxed when used for qualifying medical expenses. The funds can be used to pay for Medicare premiums, long-term care expenses, and insurance. If you use the funds for non-qualified expenses, you will pay a 20% penalty. But after age 65, that penalty no longer applies. You can use the money for anything! This makes HSAs a great retirement investing choice.

Make Catch-Up Contributions

Retirement accounts have yearly contribution limits, but in the calendar year you turn 50, you can contribute additional money, called catch-up contributions, to 401(k)s and IRAs. For HSAs, the age to make additional contributions is 55.

Conduct Regular Check-Ins

What gets measured gets managed. Check-in on your progress once a year. Are you on track to meet your retirement number? What do you need to do to get on track if you’re not? These kinds of check-ins are best done with a financial advisor. If you’re off track, they can help you create a plan to get to where you need to be.

What Mistakes Should I Avoid in Planning For Retirement?

The mistakes we make when planning for retirement can have dire consequences for our long-term plans.

Not Having a Plan

Not having a retirement savings plan is like driving to a new destination without GPS. You might get to where you’re going in the end, but it will take longer and cost you more. The cost of failing to plan for retirement might come in the form of having to work many more years than you would have wished or not being able to afford the kind of retirement you want.

This is why I believe everyone can benefit from working with a CFP® Professional.

Underfunding Retirement Accounts

Ideally, you will max out your retirement accounts each year by making the maximum contributions and maxing out the catch-up limits once eligible. These accounts will be the primary source of retirement income for many of us, so every dollar is essential.

Dipping Into Retirement Accounts

Your retirement accounts are not an emergency fund. It can be tempting to dip into them to pay for an emergency expense or something like a down payment on a home or educational expenses for children. Resist the urge. Time is your greatest asset for growing your retirement money, and dipping into it reduces that asset. Not to mention the possible penalty you’ll face for early withdrawal.

Underestimating Expenses

You might think that spending 80% of your pre-retirement salary seems absurd, that you surely can live on far less! Maybe you can. Remember what inflation was in 2020? It was 1.4%. And just two years later, it’s at a four-decade high, 9.1%.

In January 2022, the Dow hit an all-time high. In June of the same year, we entered a bear market and are possibly headed towards a recession. We don’t know what tax rates will look like in one, two, three, or four decades but odds are, they’ll be higher than they are currently.

80% doesn’t look quite so absurd now, does it? It’s always better to overestimate than to underestimate when it comes to forecasting our expenses in retirement. What’s the worst that can happen? You’ll have more money than you need!

Constantly Upgrading

In the two or so decades before retirement, you will likely be making more money than ever before, at the pinnacle of your earning power. Each year you might get a nice raise and a handsome bonus. You can jump your salary up even higher if you switch companies frequently.

Every bump in salary should not include a bump in lifestyle, a bigger home, a newer car, or more expensive vacations. By all means, reward yourself for your hard work, but the vast majority of those salary increases should go towards your retirement investments.

How Much Debt Should I Have in Retirement?

Being debt-free is the ultimate freedom, even more so than being retired. Ideally, we would be 100% debt-free before we retire. That isn’t realistic for many of us, and being debt-free shouldn’t come at the cost of being cash-poor in retirement.

Eliminate “Bad” Debt

“Bad” debt is high-interest debt that has no reward. Credit card debt is the typical type of bad debt people have. The average interest on credit cards is in the mid to high teens, much higher than the return you’d get on most investments.

If you have high-interest debt as you near retirement (and really any other time), you need to buckle down and pay it off.

We are advocates of Dave Ramsey’s Debt Snowball method.

The debt snowball method is a debt reduction strategy where you pay off debts in order of smallest to largest, gaining momentum as each debt is paid off.

Dave Ramsey recommends the debt snowball method because it’s simple and effective. When you see those smaller debts disappearing quickly, it gives you the motivation to keep going and stay focused.

Should I Pay Off My Mortgage or Invest for Retirement?

Mortgage debt can be considered “good” debt. The interest rates are typically low when compared to the rates on bad debt, and it provides a reward, a house! Which is not only a place to live but can be a financial asset too.

But for most of us, our mortgage is our largest monthly expense, and eliminating that expense is appealing. But every dollar you put towards paying off your mortgage early is a dollar not going towards your retirement investments. And that means you’re losing out on the power of time to grow your nest egg.

The better alternative is to buy a home that is affordable enough to pay off early while still investing a significant amount into your retirement investments.

Major Costs in Retirement

There are five major costs in retirement.

Housing

Housing costs include mortgage or rent, property taxes, insurance maintenance, and repairs. The average retired household spends $17,454 per year or $1,455 per month on housing costs which is more than 35% of their yearly expenses.

As an average, $1,455 isn’t bad, but many people will spend much more than that. If that’s the case for you, start considering ways to bring that down in retirement. That can mean downsizing or moving to an area with a lower cost of living.

Transportation

If you have a considerable commute, you can expect your transportation costs to come down after retirement. The average retired household spends $6,819 per year or $568 per month on transportation expenses which include auto payments, gas, insurance, maintenance, repairs, and public transit.

If you’re a two-car family, consider dropping to one in retirement. And if you live in an area with the infrastructure for walking and cycling, consider doing some errands on foot or bike. Not only will you have more money, but those activities can help keep you fit, which also saves you money on healthcare!

Healthcare

Perhaps somewhat surprisingly, healthcare clocks in at #3. The average retired household spends $6,749 per year or $562 per month on healthcare costs which include health insurance, medical services, supplies, and prescriptions.

Too many people mistakenly believe that Medicare covers all healthcare expenses. This is not true. These are some of the things Medicare Parts A and B don’t cover:

- Outpatient prescription drugs

- Long-term care

- Deductibles and copays

- Dental care

- Vision care

- Hearing aids

It’s the second one on that list that should scare you. One of the most important things you can do to protect your retirement is to purchase long-term care insurance. Each year Genworth publishes an eye-opening study on the costs of long-term care. Here are some recent numbers for monthly median costs in 2021:

- Homemaker services: $4,957

- Home health aid: $5,148

- Adult day health care: $1,690

- Assisted living facility: $4,500

- Nursing home facility semi-private room: $7,908

- Nursing home facility private room: $9,035

You can see how quickly these costs can drain even the healthiest retirement portfolio. Genworth provides very detailed information; you can search for these costs in your local area or the area in which you wish to retire. Long-term care insurance can help pay for these expenses. Your HSA account, which we discussed above, can also help pay for your medical expenses in retirement.

Food

The average retired household spends $6,137 per year or $511 per month on food expenses which include groceries and food eaten outside the home. I won’t belabor this. We all know how to spend less on food, eat out less, batch cook, and reduce food waste.

Utilities

The average retired household spends $3,797 per year or $316 per month on utility expenses which include gas, electric, water, phone, and internet. Again, we all know how to reduce these costs, an energy audit, energy-friendly appliances, programmable thermostats, etc.

What Should I do in the 5 Years Before Retirement?

Hopefully, you’ve been planning for retirement well before it’s just five years away! These are the final steps to take in the five-year run-up.

Start Thinking About What Retirement Will Look Like

Start considering things like where you want to live. Some things to think about:

- Do you want to stay in your home or downsize?

- Do you want a house, or do you prefer a condo or apartment, so you have little to no upkeep?

- Are you moving to a different area, state, or country?

- Do you plan on traveling a lot? Domestic or international?

- How are you going to spend your time?

That last one doesn’t have anything to do with money but planning for your post-working life is just as important as planning for your post-working finances. Your career was not only a big part of your life; it was a big part of your identity. What will you fill your days with, and who will you be now that you’re no longer a teacher, lawyer, CPA, doctor, or police officer? It’s a big question and one that deserves your time and attention.

Dream with Your Family

Your spouse should be part of that discussion too. If you are used to seeing each other only on weekends and evenings and suddenly find yourselves together almost 24/7, tensions can arise. The same is true if one spouse has been at home because they retired first or didn’t work outside the home. Home is their domain, and now there you are, underfoot constantly! Your retirement is a big transition for them, too, don’t forget that.

One other note from years of working with clients who have retired. Establish boundaries when it comes to looking after grandchildren. Some parents see retired grandparents as free babysitting and take advantage of it. And maybe that’s fine for you, the more time with your grandchildren, the better! But that’s not the case for everyone. Plenty of retirees have plans of their own, and frequent babysitting is not part of them. Speak to your children about that, too, to avoid conflict during your retirement.

Create a Retirement Budget

A budget is something everyone needs at every stage of life, but if you haven’t been budgeting up until now, it’s time to start. Remember, it’s estimated that you’ll need 80% of your current salary for each year of retirement.

Get that number. Add up your monthly expenses and the monthly income you expect to receive during retirement, including income from your portfolio, Social Security, pensions, and any other sources of income. Do the numbers work out? Do you have the money to retire? If not, how big is the gap? What expenses can you cut? If the money isn’t there, we’ll cover what you can do in a later section.

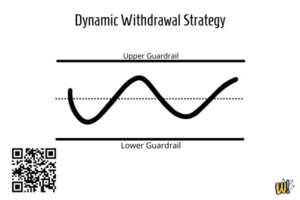

Work with a CERTIFIED FINANCIAL PLANNERTM professional to develop a dynamic withdrawal strategy or spending rule. Dynamic spending rules are designed to change annual retirement distributions based on actual market performance and often inflation rates. They can provide guardrails to adjust withdrawals up or down to prevent a retiree from over or underspending.

Eliminate High-Interest Debt

This is non-negotiable now. You can’t have debt with an interest rate in the teens eating into your retirement savings. Consider a personal loan to consolidate the debt. If your credit score is good enough, you can get a lower interest rate on the loan than you have on your credit cards. You’ll still have debt, but the debt will be less expensive, saving you money and allowing you to pay it off more quickly.

Bulk Up Cash Reserves

Accessing money from retirement accounts, pensions, and Social Security doesn’t happen overnight. There is paperwork, and sometimes red tape involved that can delay things. Six months’ worth of expenses should be more than enough to see you through any delays.

Create a Healthcare Plan

If you don’t yet have long-term care insurance, get it now. If you’re retiring before age 65 and therefore not eligible for Medicare, how will you cover your health insurance needs in that time? Additionally, if your spouse is still working, you may be eligible to be added to their plan. If not, you will need private insurance, which can be expensive.

Do not forego health insurance, not even for a short amount of time. Anything could happen, and an uninsured medical expense could wipe out your savings.

Defined Benefit Plans

A defined benefits plan is better known to most of us as a pension. And while many of us consider pensions something out of our parents’ or even grandparents’ era, somewhat surprisingly, 31% of Americans retire with a pension. The median yearly pension benefit is $9,262 for a private pension and $22,172 for a federal government pension.

There are typically two choices when it comes to receiving your pension payments, a lump sum or an annuity that gives you regular payments for the rest of your life.

Common Annuity Structure Options:

- Single life payment: You receive a monthly payment for the rest of your life, and your beneficiaries receive no further payments after your death.

- Single life with term certain: You receive a monthly payment, and if you die before the end of the specified term, your beneficiaries receive a payment for a pre-set number of years.

- 50% joint and survivor: After your death, your spouse will receive monthly payments for the rest of their life that are equal to 50% of your annual annuity.

- 100% joint and survivor: After your death, your spouse will receive monthly payments for the rest of their life that are equal to 100% of your original annuity.

Adding more stipulations typically means your monthly payment will be lower. If you’re in good health and expect to live for many years, choosing an annuity option is often the best choice. A lump sum payment may be the best choice if your health and life expectancy are less robust. Faced with so many options, consulting with a CFP® professional to help you decide how best to make use of your pension can be very helpful.

Social Security

As of June 2022, the average Social Security monthly benefit was $1,669.44. Which is enough to cover the average retiree’s housing costs which we saw above was $1,455 per month with about $214 left over. So while Social Security can be a part of your retirement budget, it can’t be your entire plan.

How Is Social Security Taxed in Retirement?

The Social Security Administration estimates that around 56% of Social Security recipients will owe income taxes on their benefits. If your total income exceeds $25,000 for an individual or $32,000 for a married couple who file jointly, you must pay federal income taxes on your benefits.

The portion of your benefits subject to taxation varies with income level. You’ll be taxed on:

- Up to 50% of your benefits if your income is $25,000 to $34,000 for an individual or $32,000 to $44,000 for a married couple who file jointly.

- Up to 85% of your benefits if your income is more than $34,000 for an individual or $44,000 for a married couple who file jointly.

Twelve states also tax Social Security: Colorado, Connecticut, Kansas, Minnesota, Missouri, Nebraska, New Mexico, Rhode Island, Vermont, Utah, and West Virginia. Something to keep in mind when deciding where to live in retirement!

When Should I Take Social Security?

You can claim Social Security as early as age 62. The conventional wisdom thought is to wait as long as possible, maximizing your monthly benefit. Benefits continue to increase until age 70. But it’s a question that will have a different answer for everyone. These are some things to consider:

- Waiting is likely the best option if you’re in good health and expect a long life. If your health is poor and you don’t expect to live for many years to come, earlier may be better; get it while you can.

- Filing for benefits before full retirement age (66 and 4 months for those born in 1956 and gradually rising to age 67 over the next few years) permanently lock you into lower benefits.

- Once you reach full retirement age, continuing to work does not reduce your benefits. Before that, you are subject to earning limits that can trigger withholdings from your payments.

- From full retirement age, until you reach 70, you can earn delayed retirement credits which boost your future benefit by ⅔ of 1% for each month you delay and increases the survivor benefits for your spouse if you die first.

Investment Strategy in Retirement

An investment policy statement (IPS) is a document created between a client and their CFP® practitioner. It outlines the client’s general investment goals, risk tolerance, time horizons, liquidity needs, and tax considerations. This document details the strategies your CFP® professional will use to pursue these goals, regulatory requirements, policies, procedures, and responsibilities agreed to by the client.

An IPS is a great tool to help your CFP® professional understand your goals, reduce compliance risk, and offer guidance through the process of implementing, managing, and periodically reviewing your investment portfolio.

General Components of an IPS:

- Your Objectives:What do you want your money to do for you and when? Your objectives should include your short-term goals (paying off debt, saving an emergency fund), medium-term goals (buying a home, buying a rental property), and long-term goals (saving for a child’s college education, saving for retirement).

- Your Risk Level:This can be hard for some investors to get right. Some people have no fear and are willing to take too much risk with their portfolio. Others are so risk-averse that left to their own judgement, they won’t outlive their money. Determining the correct balance in portfolio can position it for growth and provide stability. This is one of the most valuable things a CFP® professional does for their client.

- Asset Classes to Invest In:And not to invest in. There are the three main categories we are all familiar with: stocks, bonds, and cash/cash equivalents. Some investors include real estate, precious metals, and commodities in these classes. From there, you can further categorize asset classes based on the underlying securities. If this sounds foreign to you, don’t worry. Your CFP® practitioner is fluent!

- Target Asset Allocation:Your financial goals, time horizon, risk tolerance and asset classes (as defined in your IPS) will be the basis on which your asset allocation is created. All these factors define how much of your portfolio should be allocated between stocks, bonds, and cash.

An IPS is not something many investors have. They require a great deal of thought and planning. Many people would rather not spend the time and energy required to work with a CERTIFIED FINANCIAL PLANNER™ in creating one. But if you really want to take your financial plan to the next level, an investment policy statement is an invaluable tool.

Planning in Retirement

Once you have retired, you might think that planning is no longer needed. However, this can be an essential time to stay diligent about your finances. Next, we will talk through some strategies to consider in retirement.

Required Minimum Distributions

A Required Minimum Distribution (RMD) is the amount of money that must be distributed from an employer-sponsored plan, IRA, SEP, or Simple IRA by owners of a certain age. In 2022, you must begin withdrawing from a retirement account by April 1st following the year the account holder reaches age 72. The retiree must then withdraw the RMD amount each subsequent year based on the current calculation.

If you have multiple accounts, you will need to calculate the RMD for each separately and take it from each. What if you do not need the income? Next, we’ll cover a few different strategies to answer that question.

Roth Conversions

Roth conversions may be an option to consider if you want to convert money from a traditional IRA to a Roth IRA that will grow tax-free and not require an RMD. This is especially interesting if the IRA is going to be inherited by children because the children can inherit a Roth tax-free.

These advantages should be weighed against the tax you pay on the amount converted. Consider your current and future tax rates, your mix of assets, and your heirs’ future tax rates. Many people have a lower income in retirement and could benefit from this strategy if the income from the RMD is not needed.

Retirees should also consider the impact a Roth Conversion would have on Medicare premiums which are based on income.

Qualified Charitable Distributions

A qualified charitable distribution (QCD) is a direct transfer of funds from your IRA to a qualified charity. QCDs are counted toward satisfying your RMD for the year. A QCD excludes the amount donated from your taxable income. To qualify for a QCD, you must meet certain eligibility requirements:

- You must be age 70.5 or older to be eligible to QCD

- The maximum amount of annual QCD is $100,000 per individual.

- QCDs are limited to the amount that would otherwise be taxed as ordinary income

- The funds must come out of your IRA by the RMD deadline, generally December 31

- The charity must be a 501(c)(3) organization

Donor Advised Funds

A Donor Advised Fund (DAF) is like a charitable investment account for the sole purpose of giving to charitable causes you care about. When you contribute cash, appreciated securities, or other assets to a DAF, you get an immediate tax deduction. Those funds are then invested for tax-free growth and you can recommend grants to charities over time.

When giving cash, you can deduct up to 60% of your adjusted gross income (AGI).

When giving long-term appreciated securities, you can deduct up to 30% of your AGI. It also eliminates any capital gains taxes owed on long-term assets that have been held for more than one year.

DAFs can be a powerful tool in building a family legacy, can be passed down to successor grantors, and are great for encouraging the next generation to give generously as well.

What You Can Do if Retirement Savings are Not Enough

It can happen, even with planning. The numbers just aren’t there, and you don’t have enough retirement savings. Don’t panic. There are still things you can do to get there.

Continue Working

This is the most obvious answer and the one no one wants to hear, but you need to delay retirement if the money isn’t there. This means you can delay receiving Social Security which will increase your benefit. You can continue contributing to your retirement accounts, including catch-up contributions, and the money has more time to grow.

And, of course, it decreases the number of years you will have to draw down your investments.

Cut Expenses

I don’t mean giving up your morning Starbucks. I mean, cut the significant expenses. This is another thing none of us want to do, but when retirement is on the line, it’s non-negotiable.

The top five expenses in retirement are almost certainly the same as the top five expenses in non-retirement! Start with those.

Consult a CERTIFIED FINANCIAL PLANNERTM

There are always circumstances when a CFP® practitioner can be a great help but perhaps no more so than when you’re looking to retire, and the money isn’t there. A talented CFP® professional can introduce you to strategies and ideas you never considered. And they can see things you might have overlooked.

Things may not be as bad as you thought, or they may be worse. Either way, a CFP® practitioner can help you create a plan to get you where you need to be.

At Paradigm Wealth Partners, we use the 1 Page Wealth Plan to help Combat the 5 Big Retirement Risks, which are inflation, taxes, longevity, withdrawals, and behavior.

The 1 Page Wealth Plan addresses each of these risks by creating a personalized retirement income plan that is designed to last throughout your lifetime. We consider all aspects of your financial life, including investments, taxes, insurance, and estate planning.

You can find a copy of Jonathan’s book “What The Wealth: Identify Your Core Values, Reignite Your Dreams, and Combat the 5 Big Retirement Risks®” here.

Create The Life You Love

Planning for retirement shouldn’t be all-consuming. Proper planning is all that is required for a successful retirement. If you need help with retirement planning or any other aspect of your financial plan, we’re here to help. So you can retire and Live The Life You Love!

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of the conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.