What Issues Should I Consider Before the End Of The Year?

I think most of us will be happy to see the back of 2020. As years go, it was a bad one. But before we send 2020 off, there are a few things we need to consider so we can set ourselves up for a better (at least financially!) 2021. Here is to hoping!

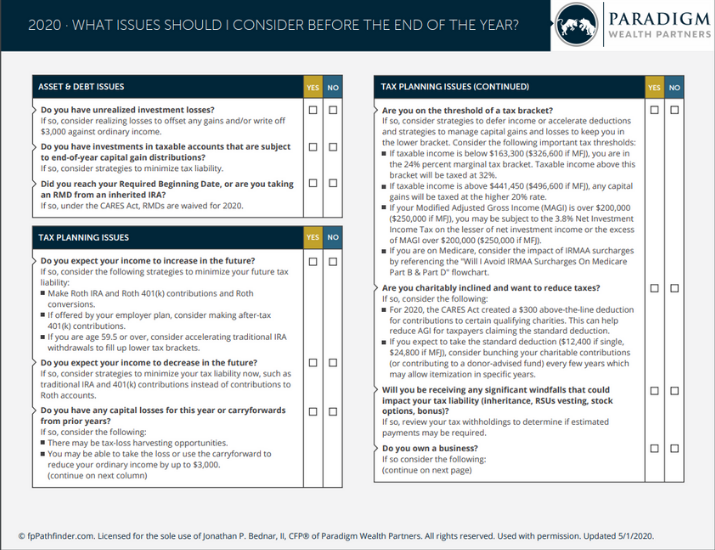

I’ve included a comprehensive checklist, but in this blog, I wanted to pick out a few key points from that checklist that I think will be relevant to many people this year.

Asset and Debt Issues

It was a wild year on Wall Street, so many of us may fall into both of these camps.

Do You Have Unrealized Investment Losses?

Of course, no one likes to lose money on an investment, but there is a way to take some of the sting out of that loss; tax-loss harvesting. Tax-loss harvesting can help reduce your taxes now and in the future. The strategy lets you sell investments that are down, replace them with similar investments, and offset realized investment gains with those losses. This means less of your money goes to taxes and more money stays invested.

A loss can be used to offset gains and to offset $3,000 of income on a joint tax return in one year. Unused losses can be carried forward from year to year indefinitely. When looking for investments to sell, consider those that no longer fit in with your overall investment strategy, have a low potential for future growth, or can easily be replaced with other investments that fulfill a similar purpose in your portfolio.

Once you’ve decided what to sell, be careful to avoid a wash-sale when determining what investments to replace them with. The wash-sale rule states that you will be unable to take the tax write-off if you buy the same security, a contract or option to buy the security, or a “substantially identical” security within 30 days before or after the date the losing investment was sold.

A simple way to avoid breaking the wash-sale is to invest in a mutual fund or ETF that invests in the same industry your losing stock was a part of.

Do You Have Investments in Taxable Accounts That are Subject to End-of-Year Capital Gain Distributions?

In this case, you want to find ways to minimize your tax liability.

Wait For Long-Term Capital Gains

Buying and selling a stock in the same year means your capital gain is short-term and will be taxed as ordinary income. Waiting to sell until after the New Year means the gain will be considered long-term and taxed at a lower rate and delayed another year.

Timing Gains and Losses

Because the 2020 market was so crazy, you may have losses and gains this year. In that case, it can be to your advantage to realize both in the same year. Suppose you have $30,000 of capital gains and $30,000 in capital losses. If you only realize the gains, you’ll have to pay taxes on the entire $30,000.

If you only realize losses, you’ll have no capital gains to offset them, and you can only deduct $3,000 against your other income. The rest of the $27,000 loss must be carried over to future years.

Rather than delaying the tax benefit of your loss, you can realize both capital gains and losses in the same year. If they completely offset each other, you won’t owe any taxes. If you don’t have a large capital loss to offset, you should generally time the realization of long-term capital gains, which are taxed at more favorable rates for those years when you don’t realize any capital losses. You can then realize future capital losses in the years when you can immediately deduct them against other income that might be taxed at the higher ordinary income rates.

Tax Planning Issues

We got a reprieve last year, and the dreaded day was pushed back a few months. Don’t count on that happening again, so prepare now.

Do You Expect Your Income to Increase in the Future?

Hopefully, the answer is yes! In that case, you want to utilize strategies to minimize your future tax liability.

Make Roth IRA and Roth 401(k) Contributions and Roth Conversions

When you contribute to a Roth IRA, you pay taxes on your income as you earn it and pay no taxes when you make withdraws after age 59 ½ when most people are in a lower tax bracket than during their working years. Contribution limits are $6,000 per year for those under 50 and $7,000 per year for those over 50.

A Roth 401(k) is similar to a traditional 401(k). It’s an employer-sponsored retirement plan, and the contribution limits are the same; $19,500 for those under 50 and an additional $6,500 for those over 50. The money contributed is taxed at the time of contribution, and withdrawals after 59 ½ are not taxed.

Roth Conversions

A Roth conversion changes an existing qualifying retirement account like a 401(k) or Traditional IRA to a Roth IRA. Making the conversion takes money currently being tax-deferred and converts it over to an account that grows tax-free. To do this, you’ll have to pay taxes on the converted amount. Why would you do the conversion? If you think you’ll benefit more from having your money grow tax-free will be greater than the cost of paying taxes when making the conversion, it’s an advantageous tax strategy.

Yes, we expect that we’ll be in a lower tax bracket during retirement than we are now, but we don’t know what future tax rates will be. So it’s a gamble but may be one worth taking.

Contribute to an Employer-Sponsored 401(k)

Contributions to a traditional 401(k) will reduce your taxable income for the contribution year. The 2020 limit on contributions are $19,500 for those under 50 and an additional $6,500 for those over 50.

Do You Expect Your Income To Decrease in the Future?

Things have been tough financially for many this year, and thousands have faced job losses and reduction of hours. Things will improve, but we don’t know when so we need to find ways to reduce our tax bill for 2020.

You can do so by making contributions to your Traditional IRA and 401(k) rather than to Roth accounts. Contributions to a Traditional IRA and 401(k) will lower your taxable income.

Cash Flow Issues

The Tax Cuts and Jobs Act made a significant change to the ways money in a 529 Plan can be used, and this might be a good time to take advantage of it.

Contribute to a 529 Plan

You can use the annual exclusion amount to contribute up to $15,000 per year to a beneficiary’s 529 account gift tax-free. Alternatively, you can make a lump-sum contribution of up to $75,000 to a beneficiary’s 529 account and elect to treat it as if it were made evenly over a 5-year period gift tax-free.

Before the Tax Cuts and Jobs Act, the money in a 529 Plan could only be used (without penalty) to pay for qualifying higher education expenses. But as of January 1, 2018, those accounts can be used to pay for up to $10,000 in tuition expenses at elementary, secondary, private, or parochial schools.

If money has been tight and you were facing pulling your kids out of private school, this is a good option. Kids have had so much upheaval this year; if you want to keep them in their current school by utilizing their 529 Plan, this is a boon for your family.

Check It Off!

As we head into the busy holiday season, we can lose track of time and find ourselves behind on the last minute end of year financial tasks that can dramatically impact our finances. We hope this checklist will make getting those tasks done easier for you this year!

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

Prior to investing in a 529 Plan investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.

#1-05079159