The Only Goal That Matters

Human beings are not always the most rational creatures. We often allow emotion to color our decisions. Sometimes we’re aware that we’re doing this and sometimes we aren’t. This is true in all facets of life, including investing. There is an entire field of study built around this known as behavioral finance.

“Behavioral finance is the study of the influence of psychology on the behavior of investors. It focuses on the fact that investors are not always rational, have limits to their self-control, and are influenced by their own biases.”

According to Traditional Financial Theory (TFT):

- The market and investors are perfectly rational

- Investors care about utilitarian characteristics

- Investors exercise perfect self-control

- Investors are not confused by cognitive errors or information processing errors

According to Behavioral Finance Theory (BFT):

- Investors are normal, not rational

- Investors have limited self-control

- Investors are influenced by their biases

- Investors make cognitive errors that lead to poor decisions

I don’t need to tell you that basing your financial decisions on emotion can have serious financial consequences. So how can we become the ideal, rational investor that Traditional Financial Theory expects us to be?

Ignoring Outside Influence

We all have financial goals. So do our friends, family members, colleagues, pundits on financial shows, and the people we’re “friends” with on social media. These people’s goals can influence our own; sometimes in such subtle ways that we aren’t consciously aware that we’re being influenced.

But we can’t know why those people make the investment decisions that they do. Basing our decisions on incomplete information is the type of cognitive error BFT warns us against.

We can lose sight of our investing goals when we obsess over market returns letting greed or fear drive our decisions. The market can have wild swings in the short-term, but over a long-time horizon, historical returns for the market can average 10% (as calculated by the average annual returns of the S&P 500 from 1980-2018)1.

“Investing success doesn’t correlate with IQ after you’re above a score of 25. Once you have ordinary intelligence, then what you need is the temperament to control urges that get others into trouble.” –Warren Buffett

Plotting Your Course

What are your financial goals? Before you can plot a course for your investments, you must answer that question. Typical financial goals include:

- Saving for a home

- Saving for your children’s education

- Starting a business

- Saving for retirement

- Leaving a financial legacy for your family

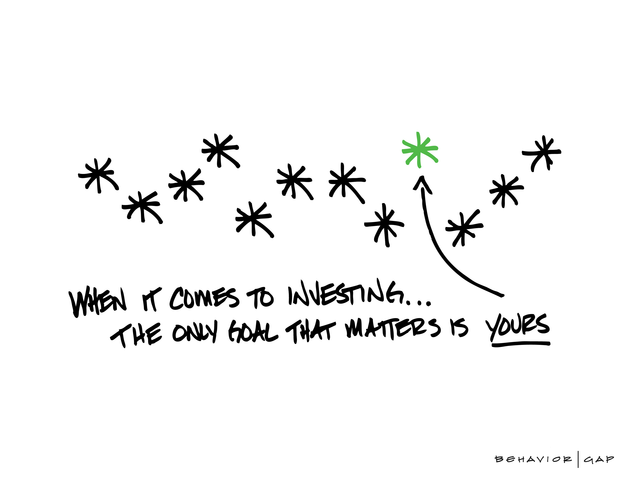

While those are some common investing goals, they’re certainly not the only goals. They may not be your goals. Everyone must define the goals that matter to them. The only goal that matters is yours.

Goals can change over time. Maybe our priorities change, or we experience life events that force us to change our goals. That means our investment strategies must be fluid as well. Your goals as an investor in your twenties might be to live frugally while investing a much higher percentage of your income than most people do at the same age. Your eye might be toward joining the FIRE movement (Financial Independence, Retire Early) which means having enough money to leave full-time employment decades earlier than the typical retirement age of 65.

But low and behold, in your thirties you find yourself married with a baby on the way. Your life goals (consequently your financial goals) and investment strategy must pivot to match these new conditions. But if you were sticking to a solid strategy, these new developments shouldn’t mean totally scrapping your current plan and starting from scratch.

While no investment strategy is one size fits all, there are certain tenets of investing that apply across the board. Any solid investment strategy and competent CFP® would use those tenets as the building blocks of a long-term financial plan. Simply make minor adjustments to accommodate the life changes that clients face.

Staying Your Course

Major life changes (even positive ones like marriage, children, and retirement) involve some degree of stress. They also often invite well-meaning (but not always solicited) advice from family, friends, colleagues, and even strangers. Add to that the often fear-mongering headlines we see about the next financial disaster and it’s no wonder people react in a way that isn’t rational.

Situations like these are when it’s critical to get an outside opinion from someone who has your best interests in mind. Especially if you and your partner can’t agree on a course of action. A CFP® is an impartial third party that can give you an overview of your situation and the current economic climate that can be hard to see when you’re looking at everything with a microscope.

Life changes, goals change, and your investment strategies change too. So long as you have goals in the forefront of your mind when making those changes, you’ll be able to ignore the noise and stay the course.

Thanks for reading! Wanting to see more about financial advice and expert opinions? Visit our blog here!

______________________

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss. Investing involves risk including loss of principal.

1 The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all the major industries. The index is unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.