How to Prepare for the Next Financial Crisis

If you didn’t learn your lesson (or were too young to be impacted), by the 2008 financial crisis, 2020-2021? Pandemic-induced financial crisis probably served as a wake-up call. Whether it’s caused by another pandemic, a climate event, a war, or something we can’t even fathom yet, let’s see how to prepare for the next financial crisis before it happens.

The Return of Normal is Approaching

The US economy—though not back to normal yet—is poised to potentially recover all of its lost output from last year’s recession during the first half of this year.

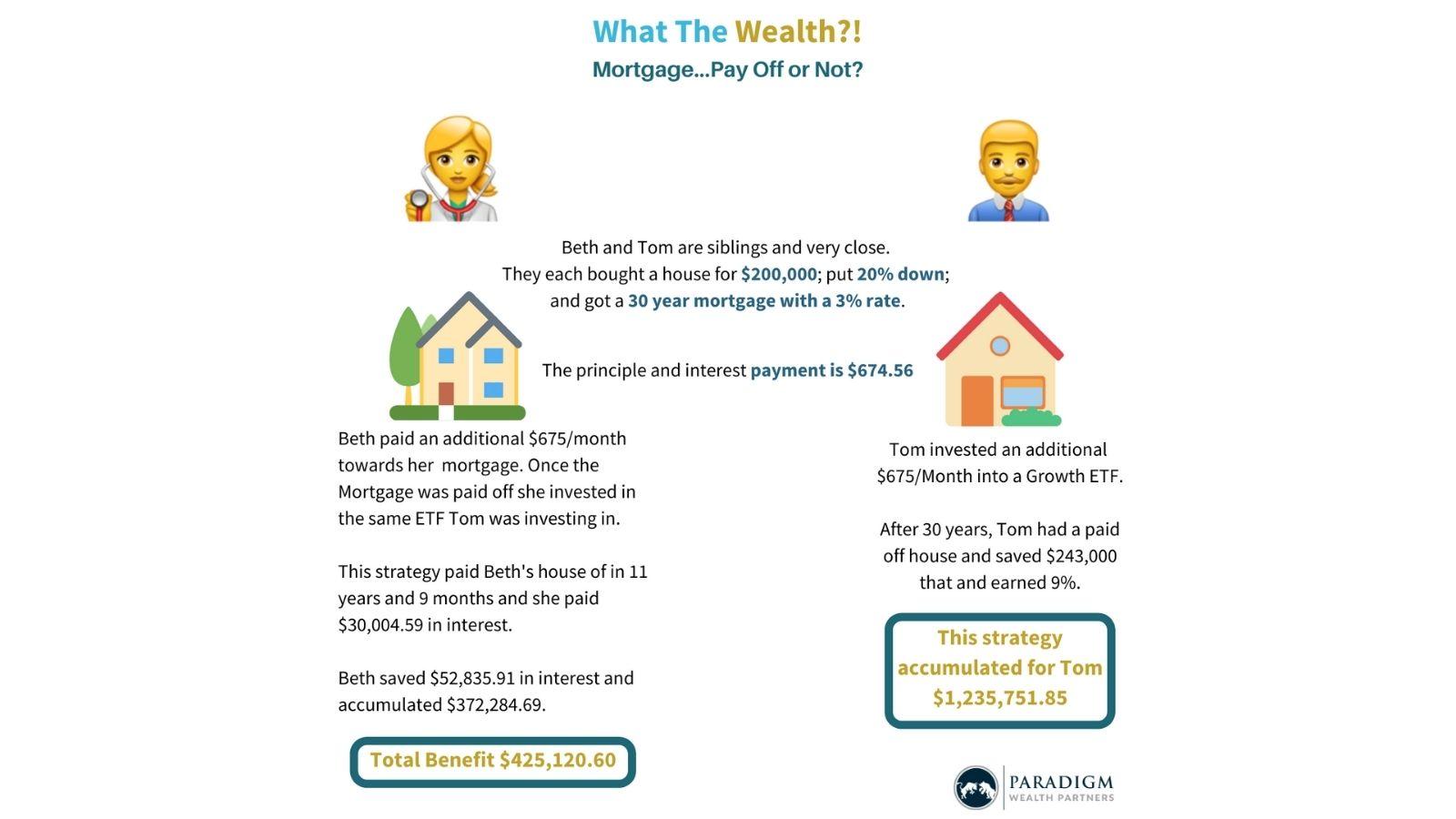

The Great Mortgage Debate: Should You Pay Your Mortgage Off Early?

Does paying your mortgage off early make the most financial sense? Let’s take a look at the pros, the cons, and a brass tacks example that should clearly and with finality answer a question I get asked a lot, “Should you pay your mortgage off early?”

Investment Personas

When we’re aware of our own investor persona and its pitfalls, we can better control our behavior and decision-making so that we can be better, more successful investors.

Stay The Course

2021 is underway, as our nation and the rest of the world look to begin to put the global pandemic behind us. The path forward for the US economy, as well as that of the global economy, will continue to depend heavily on the success of combatting the virus.

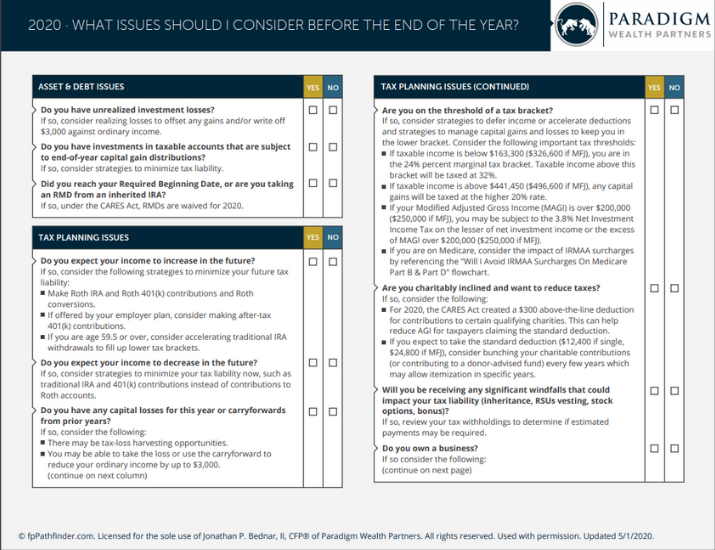

What Issues Should I Consider Before The End Of The Year? + Free Checklist

I think most of us will be happy to see the back of 2020. As years go, it was a bad one. But before we send 2020 off, there are a few things we need to consider so we can set ourselves up for a better (at least financially!) 2021. Here’s hoping!

How Much Should I Have Saved at Age 40?

We all know how important it is to save for retirement, but how do we know if we are on track to meet our savings goals? We can use these rules of thumb to check our progress and adjust if needed.

No 401(k)?

Only about 60% of American workers have the option to invest in a 401(k). Despite this discrepancy in access, the importance of saving for retirement using a tax-advantaged account remains. If you are someone without 401(k), it is important to explore alternatives.

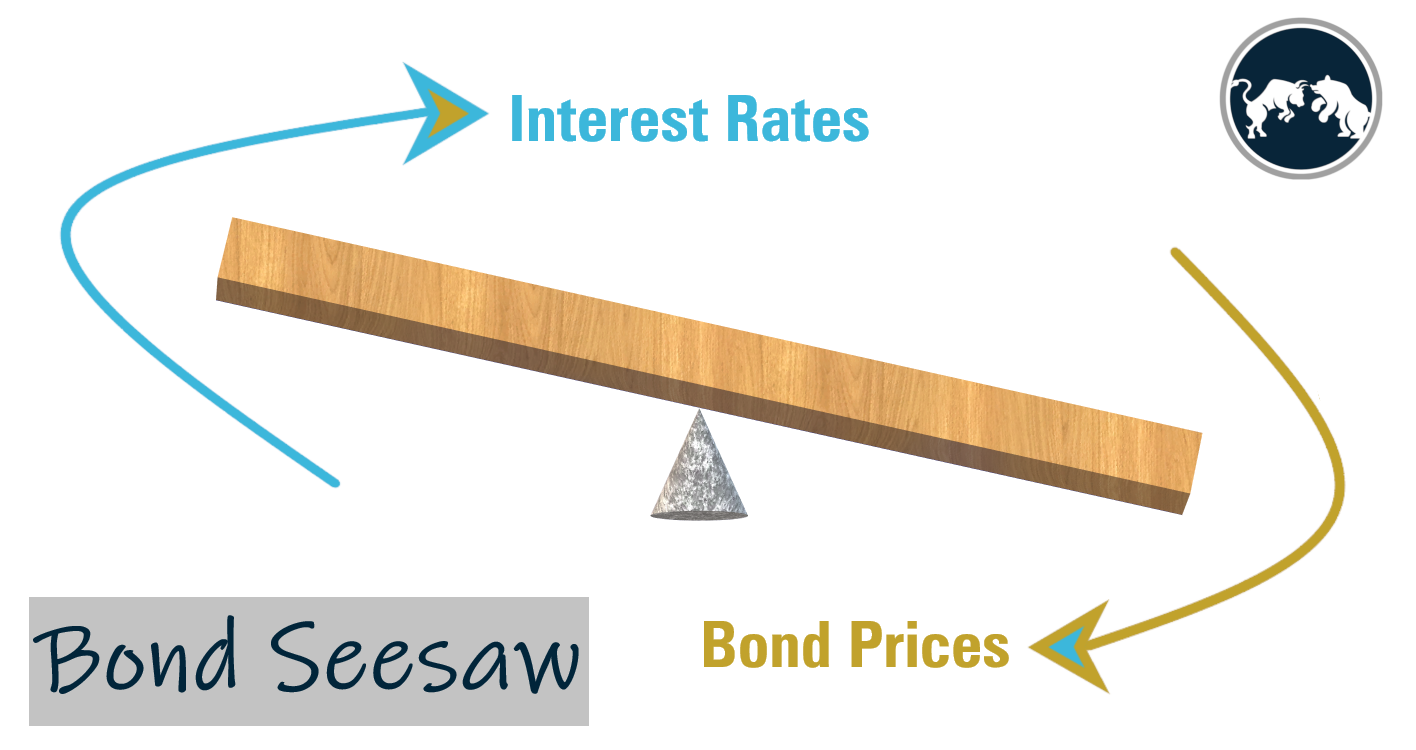

What Is Going on With the Bond Market?

Should I own bonds right now? What about those lackluster returns? Despite this, bonds still help us hedge against volatility and rebalance your portfolio.