What Is Going on With the Bond Market?

Many people are familiar with the classic 60/40 portfolio. This common strategy for retirees is composed of 60% stocks and 40% bonds (or other “lower risk” asset classes). This strategy was popularized by Jack Bogle, the founder of Vanguard. The goal was to provide retirees with a source of income (bonds) while still allowing room for growth achieved by equities.

While this is usually an appropriate asset allocation for aging adults, some financial analysts have recently questioned it given the current market conditions. This is a hotly debated topic, so we will discuss both schools of thought and let you form an opinion. First, it is important to review some bond basis.

Bonds are a type of IOU in which an issuer (a company, state, local, or Federal government) agrees to pay you a defined interest rate (coupon rate) based on a face (par) value over a period of time (maturity). Say you bought a bond at issue for $1,000 and the coupon rate is 5% with a maturity of 10 years. Interest is usually semiannual, meaning you would receive $50 twice a year for 10 years in this case. Here is the stipulation: most people do not buy bonds at issue price. They are traded in secondary markets.

It is also important to understand what changes in interest rates do to bond prices. As interest rates rise, bond prices go down. This means if rates went from 2 – 3%, prices hypothetically could go from $1010 – $990. Now let us introduce yields. The yield on a bond is its return stated as an annual percentage, influenced largely by the price the buyer pays. As the price goes down, yields go up.

Now that you have a better understanding on how bonds work, we can look at the current market. First, we will explain the problems facing the bond market.

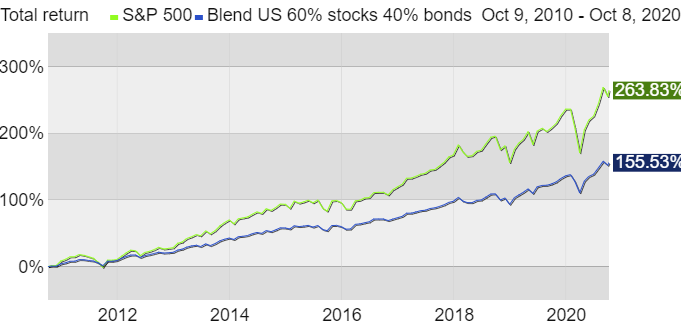

Outperformance: At “face value”, the S&P 500 has outperformed traditional 60/40 portfolios in the short and intermediate term. When looking at this graph, the 60/40 seems a bit unattractive.

“Blend US 60/40” is composed of 60% S&P 500 Total Return Index and 40% Barclays U.S. Aggregate Bond Index

Low rates: As of 10/13, the Effective Federal Funds Rate is 0.09%. One could make a reasonable case that rates could not go much lower. As we explained earlier, as rates rise, prices go down. While this does shift yields up, it raises your reinvestment risk and makes your bonds harder to sell.

Inflation: In general, when interest rates are low, the economy grows and inflation increases. However, interest rates are not keeping up with inflation. This means that if you are investing solely in bonds paying a low rate, you are actually losing money when factoring in inflation.

When looking at the bond market alone, there are reasons for concern. However, when looking at your complete financial picture, it is important to remember some key benefits from being invested in fixed income securities. MarketWatch did an adequate job defending these points:

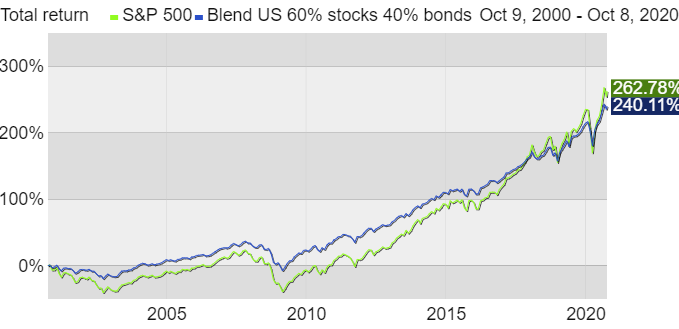

Bonds hedge volatility: Below is the same graph we saw above drawn out to twenty years. As you can see, the returns are much closer to the S&P 500. While it is true that bond returns have been unimpressive this year, they still serve a purpose in diversifying against the various unsystemic risks seen in equities.

“Blend US 60/40” is composed of 60% S&P 500 Total Return Index and 40% Barclays U.S. Aggregate Bond Index

Bonds can be used when rebalancing: To our clients in particular- when the market sells off, we can use bonds to purchase more stocks if they are low relative to their prior prices. For example, if XYZ International dropped $20 and our target allocation (the percentage of your portfolio designated to that company) was 1.5%, we could sell off some of your bonds to reach that 1.5% of XYZ International.

Bonds provide income: Although they are not dishing out as much cold hard cash as they used to, you still may wish to see some income. As previously mentioned, bonds make payments, usually semiannually, that you are free to spend as you wish (after paying taxes if applicable).

In Summary

The future of the bond market is a bit bleak right now. Some people may wish to scale back on bonds a bit. This is understandable. However, given the reasons above we still believe there is room for bonds. They help us scale against volatility, rebalance your portfolio, and give you income. Some firms are beginning to replace part of their bond allocation with dividend paying stocks. In particular, ones that have consistently paid and raised. We have always been a fan of these companies. While we are not totally writing off bonds for now, we certainly welcome this conversation. As always, your allocation depends on your risk tolerance and time horizon.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

No strategy assures success or protects against loss. Investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Dividend payments are not guaranteed and may be reduced or eliminated at any time by the company.